- Publication type

- Article

- Thematic area

- Sanctions compliance & due diligence

Introduction

In order to comply with EU restrictive measures, also called sanctions, it is important to recognise when an entity – such as a company, trust, legal person or other organisation – is owned or controlled by someone subject to sanctions. It is not always obvious when this is the case. In fact, someone subject to sanctions (whether an individual or entity, usually called a Listed Person) will often take active steps to disguise their involvement in other entities in order to circumvent sanctions.

By failing to spot when this is occurring, you risk, in certain cases, being held legally responsible for breaching sanctions.

In this article we will review why this topic is important and what it means in practice. We will also suggest some strategies for detecting the involvement of Listed Persons and explain how the EU Sanctions Helpdesk can assist you.

For the sake of simplicity, this article refers to companies, trusts, legal persons and other organisations as 'entities'.

What are the rules about a Listed Person owning or controlling an entity?

If a Listed Person owns or controls an entity (such as a company), the sanctions can also affect that entity. For example, if Person A is the target of an asset freeze – one of the most common types of EU sanctions – the Regulation that imposes the asset freeze across the EU will say something like:

'All funds and economic resources belonging to, owned, held or controlled by [the Listed Person] shall be frozen.' It will also say that 'No funds or economic resources shall be made available, directly or indirectly, to or for the benefit of [the Listed Person]'. [emphasis added]

Provisions like these mean that any company or other entity owned or controlled by Person A must also have its funds and economic resources (assets) frozen, as these can be presumed to be controlled by Person A. In addition, no funds or economic resources should be made available to that entity, as these can be presumed to indirectly reach or benefit Person A.

This presumption can be rebutted (i.e. disproved) if it can be demonstrated that the funds or economic resources in question are in fact not controlled by, or would not reach or benefit, the Listed Person, despite the Listed Person’s ownership or control of that entity.

Person A will be listed on the EU Consolidated Financial Sanctions List, and some other persons ‘associated’ with it might also be listed. But it is essential to note that, most often, entities owned or controlled by Person A will not be listed by name. This is because ownership structures can easily change, and new entities can be created. Ultimately, those doing business in the EU should consider not just who they are doing business with, but who that entity is owned or controlled by.

What does ‘ownership’ of an entity mean?

European Commission guidance states that a Listed Person owns an entity if it has 'possession of 50% or more of the proprietary rights of an entity or … majority interest in it.'

So, for example, if our Listed Person A owns 50% of Company X, Company X must also have all its funds and economic resources frozen, and no funds or economic resources can be made available to it. The same is true in the case of any shareholding exceeding 50%. As indicated above, this is because such funds or economic resources can be presumed to be controlled by Listed Person A.

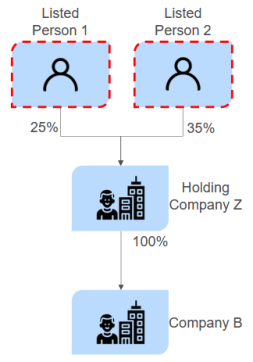

Where ownership of a company is split among more than one Listed Person, you should combine the individual shareholdings of each Listed Person to determine whether the 50% threshold is reached.

In the following example, the two Listed Persons own an aggregate total of 60% of Holding Company Z. Thus, any funds and economic resources owned by Holding Company Z should also be frozen. Because Holding Company Z owns Company B, Company B’s funds and economic resources must be frozen as well. In addition, no funds or economic resources should be made available to either company. Again, all of this results from the presumption that Listed Persons 1 and 2 have control over such funds or economic resources.

What does ‘control’ of an entity mean?

Whether someone controls an entity without actually owning it is more complicated. There are many ways of controlling a company or other entity without owning the majority of its shares. Each situation must be assessed individually, on a case-by-case basis. The Commission has provided guidance, including some examples that we have summarised here:

- Having the right or exercising the power to appoint or remove a majority of the members of leadership bodies (or having done so by exercising voting rights)

- Controlling alone, through a shareholder agreement, a majority of shareholders' or members' voting rights

- Having the right or the power to exercise a dominant influence over a legal person or entity

- Having the right to use all or part of the assets of that entity

- Managing the business on a unified basis while publishing consolidated accounts

- Sharing jointly and severally the financial liabilities of the entity or guaranteeing them

You must be aware, however, that these are only examples and not a complete list. You should consider the risk of other mechanisms that might allow a Listed Person to control an entity.

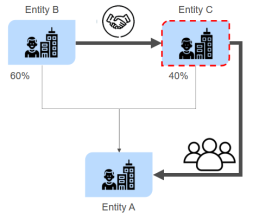

Looking at another example, Entity C owns 40% of Entity A, so it does not meet the Ownership test. Entity B owns 60% and is considered the owner. However, if there is a shareholder agreement where Entity B grants Entity C the power to appoint the majority of the board of directors of Entity A, then Entity C controls Entity A. If Entity C is a Listed Person and subject to an asset freeze, then Entity A will be affected by sanctions even if the actual majority owner (Entity B) is not Listed.

As above, the funds and economic resources of an entity controlled by a Listed Person must be frozen, as they can be presumed to be controlled by the Listed Person, and no funds or economic resources can be made available to the entity, as they can be presumed to indirectly reach or benefit the Listed Person.

Firewalls: rebutting the presumption of ownership or control

As set out above, the presumption of control of an entity by a Listed Person can be rebutted (disproved). One way of doing this is for an EU entity to implement safeguards to prevent the Listed Person from exercising control rights so that the EU entity’s business operations can continue, while ensuring the Listed Person does not benefit. These safeguards are known as a 'firewall'.

How firewalls are established is complex and outside the scope of this article. However, once a firewall is established, it can be authenticated by a National Competent Authority, which will issue an official written confirmation.

If you are told that someone you are doing business with is protected by such a firewall, you should seek a copy of the official confirmation and check it with your National Competent Authority.

What steps do I need to take?

The best protection you can have is an effective sanctions compliance programme that enables you to undertake reasonable sanctions due diligence. This programme should recognise the potential for sanctions risk exposure through Listed Persons owning or controlling entities that you deal with.

In our article on sanctions due diligence, we suggest that you:

- Collect information from your counterparty or from other public sources and ownership registers

- Verify information where you have any doubts or there are ‘red flags’

- Ask questions to seek to resolve any remaining concerns

You do not need to start from a position of being suspicious of everything a new potential counterpart tells you, as most business counterparts are exactly who and what they claim to be. Your task is to identify those that are not. You need to recognise when a counterpart or an activity poses a higher sanctions risk and undertake more enquiries in those situations. This is known as taking a risk-based approach.

How the EU Sanctions Helpdesk can help you

The EU Sanctions Helpdesk is an initiative funded by the EU to help SMEs and other organisations comply with EU sanctions. We can:

- Answer your questions on the applicability of EU sanctions

- Offer you guidance on performing sanctions due diligence, including assessments of ownership and control

- Undertake sanctions due diligence for you, free of charge, if you encounter red flags or you simply need support

If you have a question on a transaction, find out how to get support.

Where else can I find help?

If you need further help, guidance or advice, you should contact a professional or organisation that specialises in sanctions. You should also consider:

- Reaching out to your National Competent Authority

- Consulting other helpful resources

- Attending one of our awareness-raising events